Feb 13, 21 · When I fill out the 1099 NEC it automatically fills out the schedule c But it adds the income to both lines So the 1099 goes up by the income amount as well as the schedule cI recently received 1099NEC form from my employee and while filing taxes, turbotax asks me to (REVIEW and ADD the amount in Schedule C if needed) I just do NOT know what amount should be in thereGenerally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employee

Form 1099 Misc Instructions

1099 nec form link to schedule c

1099 nec form link to schedule c-However, the service provider needs to have a copy, in order to file that income on their own tax records, under Schedule C What is the deadline for 1099NEC?Dec 14, · 1099NEC vs 1099MISC The 1099NEC is now used to report independent contractor income But the 1099MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney Although the 1099MISC is still in use, contractor payments made in and beyond will be reported on the new form 1099NEC

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

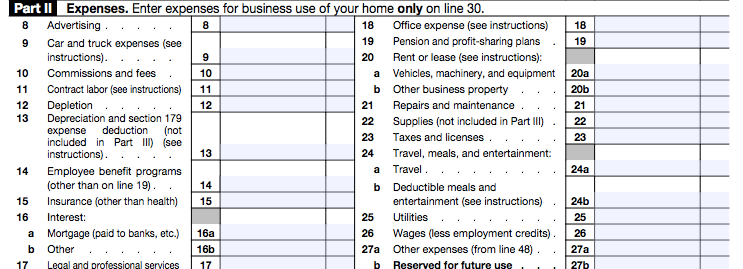

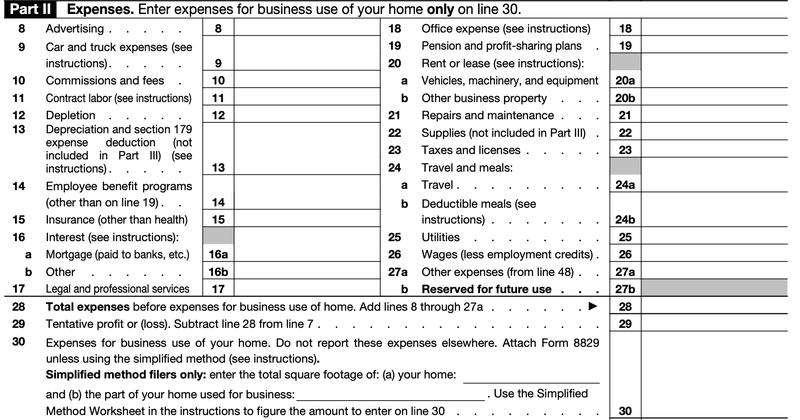

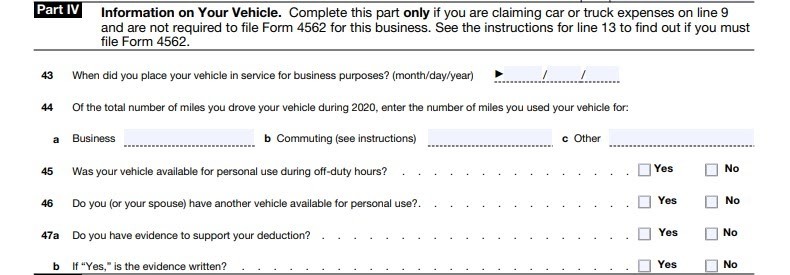

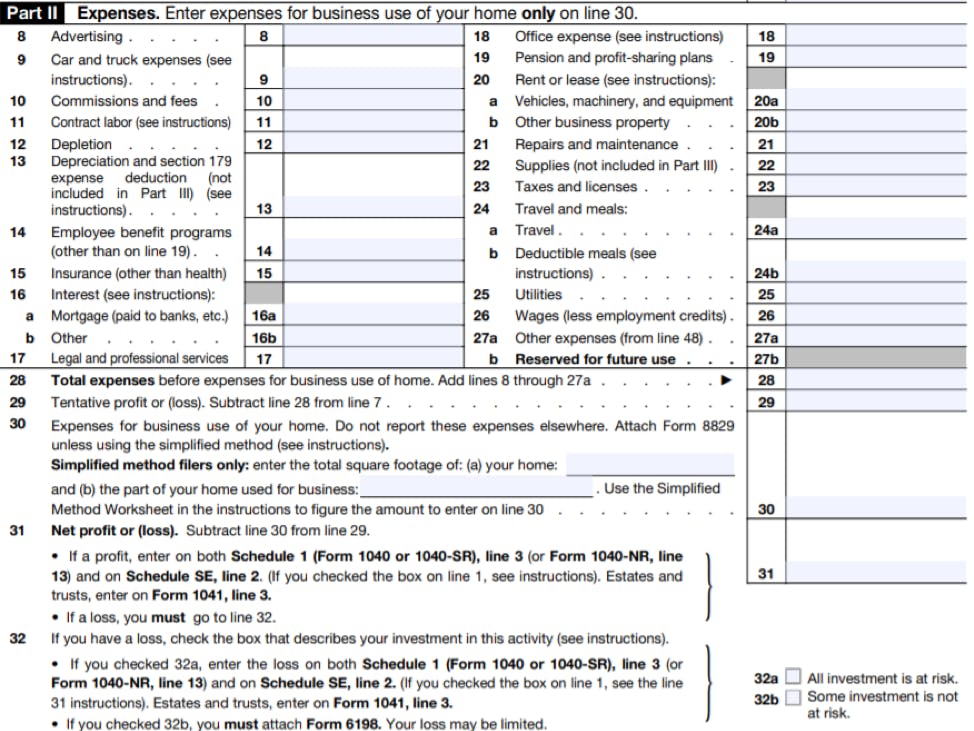

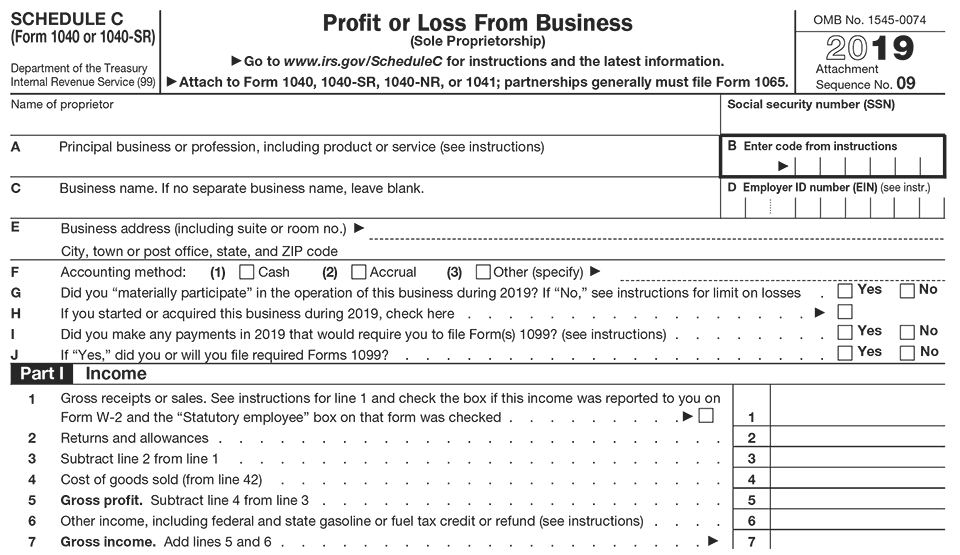

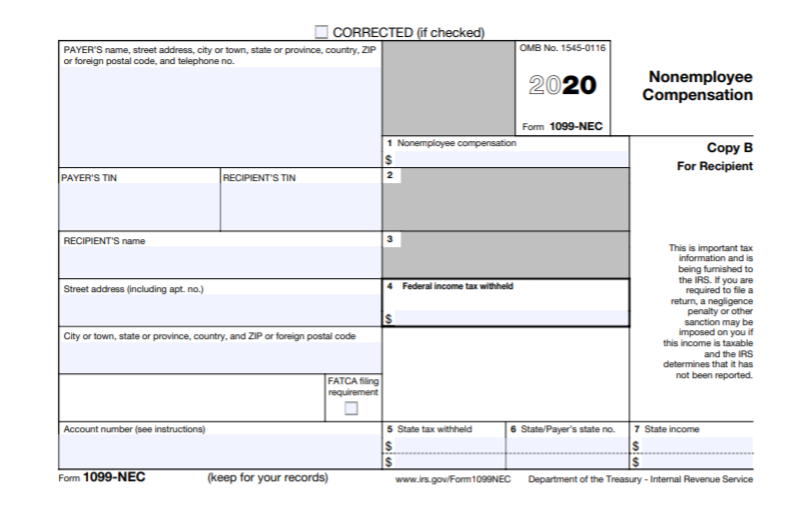

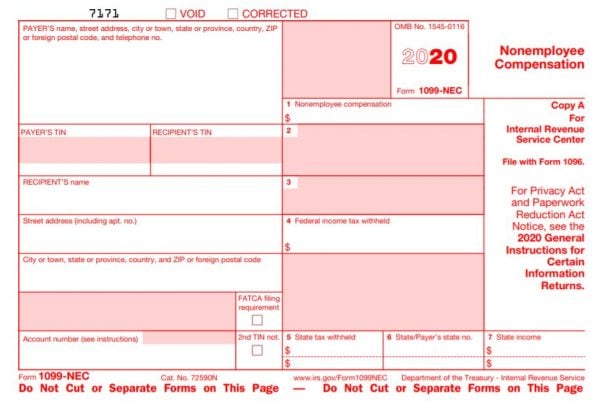

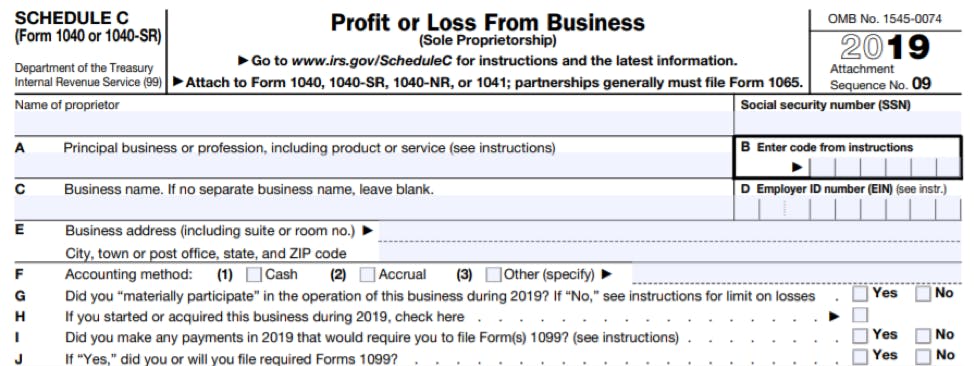

The 1099NEC form has replaced what used to be recorded on Form 1099MISC, Box 7 You will complete and send a 1099NEC form to any independent contractors or businesses to whom you paid over $600 in fees, commissions, prizes, awards, or other forms of compensation for services performed for your businessMenu Path Income > Business Income > Business Income (Schedule C) The IRS considers consulting or contractor income as business income that needs to be entered on a Schedule C If you have selfemployment income from a 1099NEC, which is the case with most Form 1099NECs, you'll need to report the income on Schedule C Add a businessSchedule C is the form used to report income and expenses from selfemployment This can encompass owning a digital or brickandmortar small business, freelancing, contracting, and gig work such as rideshare driving If you receive a Form 1099MISC, 1099NEC, and/or 1099K, you are likely to have to report it on Schedule C

Income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form 1065 and Schedule K1 (Form 1065) if a partnership, and the Form 1099NEC, call the information reporting customer service site toll free at or (not toll free) Persons with a hearing or speechForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeType in "schedule c" (or for CD/downloaded TurboTax, click Find) Click on "Jump to schedule c" Click on the blue "Jump to schedule c" link If you already have created a Schedule C in your return, click on edit and go to the section to Add Income This is where you will reenter the Form

May 07, 21 · The due date for payers to complete the Form 1099NEC is Jan 31 (Feb 1 in 21, due to Jan 31 falling on a weekend) Recipients receive a 1099NEC if they were paid more than $600 in one yearMar 02, 21 · What is Schedule C?1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting 1/25/21 Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC income

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

How To File Schedule C Form 1040 Bench Accounting

Form 1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center income, report it on Schedule C or F (Form 1040 or 1040SR), and complete Schedule SE (Form 1040 or 1040SR) You received this form instead of Form W2 because the payer did not consider you an employee and did not withholdJan 31, 21 · Any income reported on Form 1099NEC is not reportable directly on your tax return Since this type of income is considered selfemployment (nonemployee compensation) it must be linked to a Schedule C, even if there are no expenses being claimed To add a Schedule C so your 1099NEC can be linked Open or continue your return in TurboTaxJan 25, 21 · A 1099NEC form is used to report amounts paid to nonemployees (independent contractors and other businesses to whom payments are made) Nonemployees receive a form each year at the same time as employees receive W2 forms—that is, at the end of January—so the information can be included in the recipient's income tax return

What Is Form 1099 Nec Nonemployee Compensation

I Received A Form 1099 Nec What Should I Do Godaddy Blog

Feb 12, 21 · Income reported on form 1099NEC is selfemployment income, even if you are not in the graphic design business It should be reported on Schedule C You can deduct any ordinary and necessary expenses and will be taxed (income tax and selfemployment tax) on the net income To deduct expenses, you will need to upgrade to TurboTax SelfEmployedHello, Isn't 1099S a different form from 1099NEC?Form 1099MISC Miscellaneous Income (Info Copy Only) 11// Form 1099NEC Nonemployee Compensation Form 1099NEC Nonemployee Compensation 21 Form 1099OID Original Issue Discount (Info Copy Only) 1019

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Step By Step Instructions To Fill Out Schedule C For

If you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click hereBeginning in Drake, nonemployee compensation will be reported on Form 1099NEC, line 1, not on Form 1099MISC, line 7 More information may be found in Form 1099NEC Instructions Form 1099NEC is located on the General tab of data entry on screen 99NThere is also a link on the 99M screen, in the top left hand corner, that goes directly to the 99N screenSep 17, · The new Form 1099NEC—which is actually an old form that hasn't been in use since 19—is used to report any compensation given to nonemployees by a company The IRS has separated the reporting of payments to nonemployees from Form 1099MISC and redesigned it

Schedule C Multiple 1099 Misc 1099 Nec For Same Business 1099m 1099nec Schedulec

What Is A 1099 Form H R Block

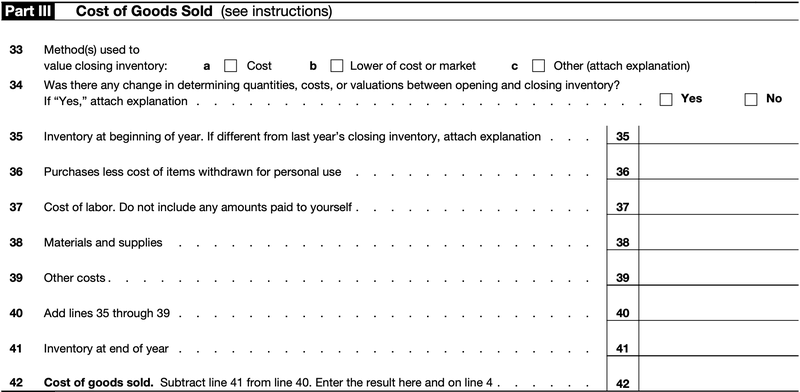

Nov 21, · You dont need the 1099 to report Sch C income, just enter all business income on Line 1 of the Sch C (since most self employed people have income in addition to the 1099 anyhow), as long as all income gets reported, that's all thats neededJan 05, · Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, andFeb 11, 21 · If any payment is not subject to selfemployment tax and not reportable anywhere else on Form 1099NEC, report the amount in Box 3 of Form 1099MISC Box 2 Direct sales If you made any direct sales of $5,000 or more of consumer products for resale, buysell, depositcommission, or any other basis, enter an "X" in the checkbox

Form 1099 Misc Instructions

What Is A Schedule C Stride Blog

Jan 31, 21 · Income reported on Form 1099NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form Revisit the section where you entered the Form 1099NEC if you entered it on its own and delete that entry, by following these stepsForm 1040, Schedule C, is also used to report wages and expenses the taxpayer had as a statutory employee or certain income shown on Form 1099MISC or Form 1099NEC Some employers misclassify workers as independent contractors and report their earnings onFeb 05, 21 · In order to claim tax withheld on 1099NEC income, the IRS and most states require Lacerte to recreate a digital copy of the Form 1099NEC your client received and include it in the efiled return The program uses your input in Form 1099MISC/NEC for EFile Returns to meet this agency requirement, AND to report withholding amounts on the

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

'Form 1099NEC Worksheet (DoorDash, Inc) A Link to Schedule C or another form is something we need to get your info in the right place Go to "Federal" and then "Income & Expenses" Select "Income from 1099NEC" Make sure to complete all of the info in this area'If you have multiple Schedule C forms and multiple 1099M/1099NEC forms, make sure you enter the correct MFC (Multiform Code) In the example below, the florist would be MFC 1, landscaping MFC 2, and woodworking MFC 3 Go to the first Schedule C created from your 99M/99N screens and enter in the profession, business code and name of the businessFeb 04, 21 · Select the Form 1099MISC/NEC hyperlink at the top right of the input Enter the Payer Information from Form 1099NEC Scroll down to the 1099NEC subsection Enter the box 1 amount in (1) Nonemployee compensation Enter the box 4

1099 Misc Form Fillable Printable Download Free Instructions

Irs To Reinstate Form 1099 Nec Requests Comments On Draft

Form 1099NEC due date is January 31st However, in 21, the due date for 1099NEC isFeb 22, 21 · Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NEC PDF Instructions for Form 1099MISC and Form 1099NEC (Print Version PDF) Recent Developments None at this time Other Items You May Find Useful All Form 1099NEC Revisions Other Current ProductsThe payer may have forgotten to prepare and submit a 1099 NEC form for the income paid to you Even though, you need to ask the payer about the 1099 NEC Form to file your tax returns for the tax year Mostly, the payers don't issue a 1099 NEC Form hen the payments are below $600

What Is Form 1099 Nec For Nonemployee Compensation

1099 Nec Conversion In

Jan 04, 21 · Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship);Jul 23, · Companies use Form 1099NEC to report income earned by people who work as independent contractors rather than regular payroll employees Here is the form The IRS requires businesses to mail a 1099 form directly to the independent contractor, so that the IRS can predict how much tax revenue to expect from selfemployed individualsIf payments to individuals are not subject to this tax, report the payments in box 3 of Form 1099MISC However, report section 530 (of the Revenue Act of 1978) worker payments in box 1 of Form 1099NEC To enter the applicable Schedule C information From within your TaxAct return (Online or Desktop), click Federal

What Is Irs Form 1099 Nec Everything You Need To Know

What Do The Income Entries On The Schedule C Mean Support

Also file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment incomeYou can Create a new Schedule C or add the income to an existing Schedule C (same type of work) The income from the 1099Misc Box 7 or 1099NEC will be automatically pulled to the Schedule C If you have already added the 1099MISC/1099NEC in the program you will need to take different steps to associate the Schedule C to the 1099MISC/1099NEC

1099 Misc Vs 1099 Nec Understanding Tax Form Differences And Deadlines

What Is Form 1099 Nec Turbotax Tax Tips Videos

Form 1099 Misc Vs Form 1099 Nec How Are They Different

How To Fill Out And Print 1099 Nec Forms

1099 Nec Form Quicken

What Is A 1099 Nec Stride Blog

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Self Employed Vita Resources For Volunteers

1099 Misc Form Fillable Printable Download Free Instructions

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

How To File For Taxes As A 1099 Worker Form Pros

Form 1099 Schedule C Business Expenses File Irs 1099 Form

Form 1040 Schedule C Cute766

Step By Step Instructions To Fill Out Schedule C For

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

What You Need To Know About Instacart 1099 Taxes

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Form 1099 Nec Nonemployee Compensation 1099nec

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

What Is Form 1099 Nec Nonemployee Compensation

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

How To File For Taxes As A 1099 Worker Form Pros

What Do The Expense Entries On The Schedule C Mean Support

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

1099 Rules For Business Owners In 21 Mark J Kohler

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec For Nonemployee Compensation H R Block

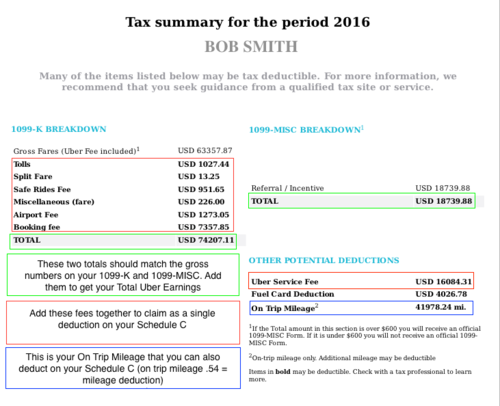

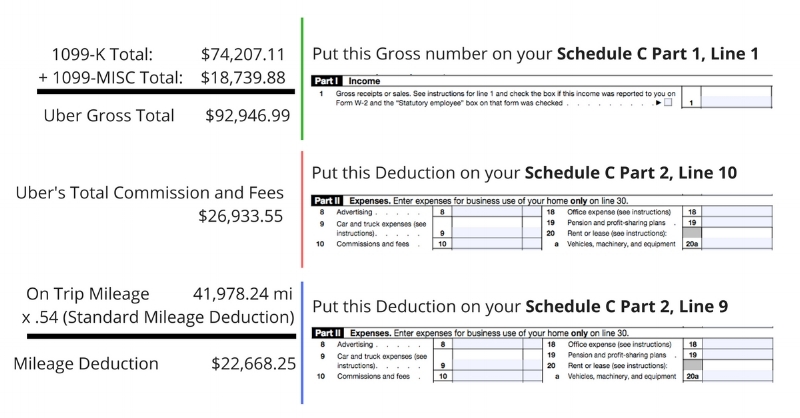

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Understanding Your Instacart 1099

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Understanding Your Doordash 1099

How To File Schedule C Form 1040 Bench Accounting

Ultratax Cs Tax Forms Zbp Forms

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

1099 Nec Schedule C Won T Fill In Turbotax

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Is Irs Schedule C Business Profit Loss Nerdwallet

Form 1099 Nec What It S Used For Priortax Blog

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Freelancers Meet The New Form 1099 Nec

Form 1099 Nec Is Making A Come Back

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

How Do I Link To Schedule C On My 1099 Misc For Bo

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Form 1099 Nec Block Advisors

Rcjvpmvvc0vwkm

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Form 1099 Nec Nonemployee Compensation 1099nec

All About Forms 1099 Nec And 1099 K Brightwater Accounting

21 Schedule C

Form 1099 Nec What It S Used For Priortax Blog

Freelancers Meet The New Form 1099 Nec

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Form 1099 Nec Requirements Deadlines And Penalties Efile360

:max_bytes(150000):strip_icc()/Form1099-aeb4be046fe64c148a594971594ece90.png)

What Is Form 1099

How To Create A Schedule C

Re 1099 Misc Income Doesn T Appear On Schedule C

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

What Is An Irs Schedule C Form And What You Need To Know About It

How To File Form 1099 Nec For Tax Year 123paystubs Youtube

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Your Ultimate Guide To 1099s

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Schedule C 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Is A Schedule C 1099 Nec

0 件のコメント:

コメントを投稿